Rate Cut of 0.25% to 4.10%: Good News for Property?

Grant Matterson LJ Hooker Narrabeen

In today’s post you will find-

Rate Cut of 0.25% to 4.10%: Good News for Property?

Narrabeen Fire Station History

Property Values- Recent Local Sales dated 18/02/25

What Will Australian Property Prices Look Like in 2025?

Hey everyone,

Hope you're having a great week!

The RBA's decision to cut the cash rate to 4.10% by 0.25% and has several potential implications for the Australian property market, based on historical trends and expert analysis:

Potential Impacts:

Increased Buyer Demand: Lower interest rates can boost buyer confidence and increase borrowing capacity, potentially leading to higher demand for properties. This could be particularly noticeable in markets like Sydney and Melbourne, which are historically more sensitive to interest rate changes.

Price Growth: Increased demand can put upward pressure on property prices. Some analysts predict that even modest rate cuts could lead to significant price increases in certain areas, especially those that have seen recent price declines.

Increased Investor Activity: Lower interest rates make property investment more attractive by reducing borrowing costs. This could lead to a rise in investor activity, further contributing to demand and price growth.

Regional Variations: The impact of rate cuts may vary across different regions. Historically, markets in Sydney and Melbourne have shown a stronger response to interest rate changes compared to other areas like Perth and Adelaide, where local economic factors can play a more significant role.

Affordability Challenges: While lower rates can improve borrowing capacity, they may not fully address affordability challenges in some areas, particularly for first-home buyers.

Important Considerations:

Magnitude of Cuts: The extent of the impact on the property market will depend on the size and frequency of future rate cuts. A series of cuts is likely to have a more pronounced effect than a single, small reduction.

Other Factors: Interest rates are just one factor influencing the property market. Other factors such as economic growth, consumer confidence, housing supply, and lending conditions also play a crucial role.

Uncertainty: The property market is inherently unpredictable, and past trends are not always indicative of future outcomes. There are always uncertainties and risks to consider.

Overall, the recent rate cut could provide some support to the Australian property market by stimulating demand and potentially leading to price growth. However, the extent of the impact will depend on various factors, and the market remains sensitive to broader economic conditions and future rate decisions.

It's important to stay informed about market trends and seek professional advice before making any property decisions.

Sources and related content

RBA relief: Rates are cut – how much could you save? - realestate.com.au

Which housing markets could get the biggest boost from rate cuts? | CoreLogic Australia

Rate cuts set to lift property values in key Australian markets

What this means for homeowners is that now, more than ever, informed decisions are key. It's a chance to really understand your property's position, to think about what you want to achieve, and to make moves that align with your goals. Whether that's upsizing, downsizing, investing, or simply staying put and making the most of where you are, knowledge is power.

🔥🚒Narrabeen Fire Station History

🔥🚒Narrabeen Fire Station.

Today’s episode of “Love Our Area” is a quick look at the history of the Narrabeen Fire Station building, where some of our local heroes are stationed. The first Narrabeen Fire Station was built by workers from the fire brigade's own workshop in 1919. The timber fire station cost £100 to build and was officially opened on January 27, 1920. The station we see today was opened on September 25, 1931. In 1929 the Board of Fire Commissioners bought another block of land close to the original fire station and paid £3100 for a two-storey brick fire station to be built. The residential part of the new fire station, which was occupied by Station Officer Aubrey Gundry, was finished on September 25, 1931, and the fire station became operational three days later. I am Grant Matterson LJ Hooker Narrabeen

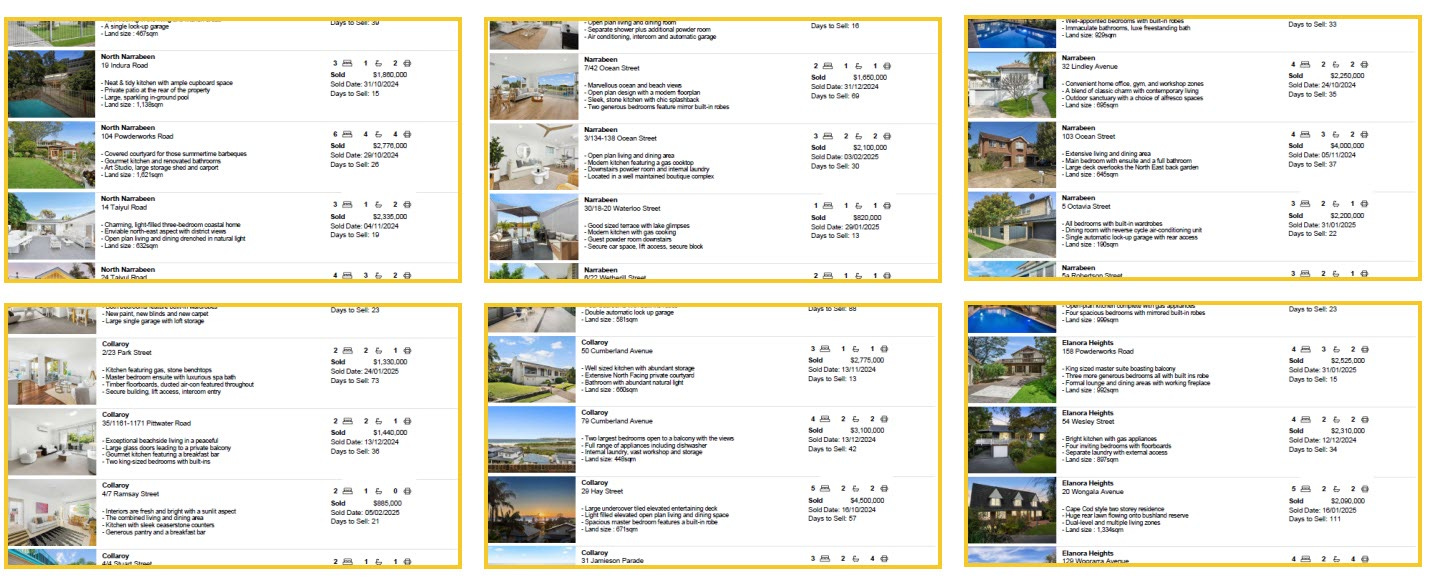

Let’s take a look at the latest recent sales in the area

Recent Local Sales dated 18/02/25

Click on the Links to View Local Recent Sales

Narrabeen House Sales Narrabeen Unit Sales Collaroy House Sales Collaroy Unit Sales Nth Narrabeen Sales Elanora Hts Sales

Warriewood House Sales Warriewood Unit/Townhouse Sales

What Will Australian Property Prices Look Like in 2025?

Speculating on what will happen to property prices in the year ahead is a favourite pastime of Australians, especially over the summer break.

Skyrocketing property prices over the past 22 months – particularly in major cities like Sydney, Melbourne and Brisbane – have made real estate a constant taking point. Parts of South Australia, Western Australia and southeast Queensland are also attracting solid interest from investors.

After a prolonged period of attractive gains and high yields, one thing is clear: we all wish we had a crystal ball to reveal where the market is heading next.

Property prices don’t just represent opportunities for buyers and sellers; they also reflect what’s happening in the broader community. According to CoreLogic, despite elevated interest rates and global uncertainty in 2024, the Australian housing market demonstrated remarkable resilience. So, let’s take a look at what could be in store for the year ahead including hotspots.

What role will interest rates have on sales?

An above-average number of listings is set to keep property sales active in 2025, but market performance will hinge on when the Reserve Bank of Australia decides to lower interest rates.

LJ Hooker Head of Research, Mathew Tiller the ‘higher for longer’ interest rate environment is putting pressure on household budgets and mortgage holders. The RBA is, however, unlikely to take any action before May due to persistent inflation, robust employment markets and global economic uncertainty. Price growth is still positive but momentum is slowing due to affordability constraints.

“Interest rate will heavily influence market performance in 2025, and the impact will be dependent on the timing and the depth of the cut,” Mr Tiller said.

“An earlier announcement and a significant reduction will likely strengthen the market, while prolonged rate stability at elevated levels may soften conditions.”

Will the Federal Election have any impact on the market?

According to the LJ Hooker Group, the 2025 Federal Election will have a minimal market impact with both major parties lacking transformative housing policies. Housing supply remains constrained due to high construction costs, labour shortages and lengthy planning processes.

“Government action on housing supply by dramatically improving the feasibility of building new homes will be critical to addressing the longer-term supply imbalance,” Mr Tiller said.

“We need our politicians to step up with direct funding for house projects, streamlined planning systems, reduced taxes and levies, and increased skilled construction worker immigration, especially for regional areas.”

Is the property market likely to be competitive in 2025?

Homeowners are likely to look to take advantage of recent price growth in the year ahead, while buyer demand should remain consistent, driven by strong population growth, rising wages, tight rental demands and a shortage of newly constructed houses.

Listings were 10 per cent above average during a highly active spring season, and real estate agents are expected to remain busy in 2025.

Sellers will likely fall into two groups in the New Year: those listing early to capture post-holiday demand and those waiting for rate cuts to boost buyer activity and sales price.

“Likewise, we will also have two groups of buyers,” Mr Tiller said.

“Some will be looking at entering the market early, anticipating increased competition once rates are cut. Others are waiting for reduced interest rates to improve borrowing capacity and ease household budget pressures.”

Auction campaigns are expected to remain popular in 2025, with vendors likely to take an attractive early offer depending on the level of interest.

“This is the beauty of an auction campaign, you can sell before, on the day or afterwards – so you have three chances,” Mr Tiller said.

What is happening in the investor market?

Buying an investment property is still seen as a positive strategy for building wealth and a secure financial future. It can enhance case flow, provide valuable tax benefits and is often considered a more stable option.

More recently, investors have been de-leveraging portfolios under cashflow pressure from high interest rates, with those who have purchased in Victoria particularly impacted by new taxes and regulations.

Some investors, however, have diverted their attention to high-growth regions in South Australia, Western Australia and southeast Queensland – a trend expected to continue in the year ahead.

DISCLAIMER - The information provided is for guidance and informational purposes only and does not replace independent business, legal, and financial advice which we strongly recommend. Whilst the information is considered true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information provided. LJ Hooker will not accept responsibility or liability for any reliance on the blog information, including but not limited to, the accuracy, currency, or completeness of any information or links.