Federal Budget at a glance 2025-26

Grant Matterson LJ Hooker Narrabeen

In today’s post you will find-

Video- Let us talk about running a successful property Auction

Property Values- Recent Local Sales dated Friday 28th March

The LJ Hooker Federal Budget 2025-26 Report provides an overview of the Australian Federal Government's budget

Hey everyone,

Hope you're having a great week!

Let us talk about running a successful property Auction

Let’s take a look at the latest recent sales in the area

Recent Local Sales dated Friday 28th March 2025

Click on the Links to View Local Recent Sales

Click here for FREE Market Estimate of Value on your Home or (Simply send me a text to 0438 261 600 with your detials)

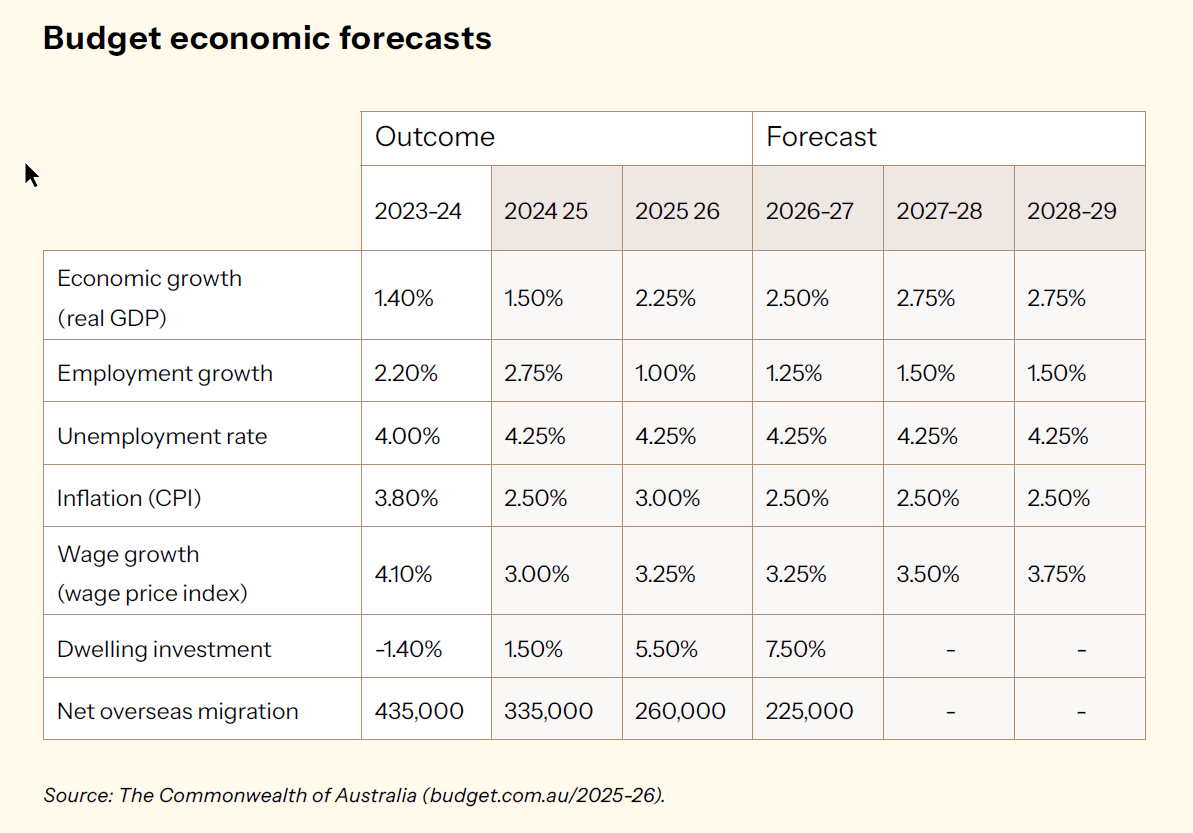

Federal Budget at a glance 2025-26

The LJ Hooker Federal Budget 2025-26 Report provides an overview of the Australian Federal Government's budget, highlighting its focus on *cost-of-living relief* amidst lower inflation and global economic uncertainties, projecting a return to a *budget deficit*. While acknowledging a still active *property market* supported by recent rate cuts and population growth, the report notes constrained housing supply and details specific budget measures aimed at improving **housing affordability and supply*, including expansions to the Help to Buy scheme and investments in modular construction. Additionally, the report outlines impact on the *commercial property market* and summarizes other budget measures such as tax cuts and infrastructure spending. Overall, the document offers an analysis of the budget's key economic forecasts and its anticipated effects on various sectors, particularly the residential property market.

Here are 10 key initiatives and areas of focus from the 2025-26 Federal Budget, as outlined in the provided LJ Hooker report:

* Targeted Cost-of-Living Relief: The budget focuses on providing direct financial assistance to ease cost-of-living pressures. This includes measures like energy bill relief for households and small businesses.

* Expansion of the Help to Buy Scheme: An additional $800 million is allocated to expand the Help to Buy scheme by increasing property price and income eligibility caps, aiming to assist up to 40,000 first-home buyers.

* Investment in Crisis and Transitional Housing: $1 billion in new funding is provided through the National Housing Infrastructure Facility to deliver more emergency housing, particularly for vulnerable individuals.

* Measures to Accelerate Housing Supply: The budget includes several initiatives to boost housing supply, such as $54 million to accelerate modular and prefabricated housing construction and $120 million to encourage states to cut planning red tape.

* New Housing Construction Apprenticeship Stream: A targeted stream will be launched on 1 July 2025, offering direct payments to apprentices (up to $10,000) and hiring incentives for employers (up to $5,000) to address skills shortages in the building sector.

* Restrictions on Foreign Investment in Existing Homes: A two-year ban on foreign investors purchasing established homes will be implemented starting 1 April 2025.

* Significant Infrastructure Spending: The budget allocates an additional $17.1 billion for infrastructure projects aimed at improving transport networks, supporting housing delivery, enhancing freight movement, and creating jobs.

* Personal Income Tax Cuts: A two-stage income tax cut will commence on 1 July 2026, with further reductions in 2027, aiming to save the average taxpayer $536 per year by 2027–28.

* Student Debt Reduction: A 20% reduction in outstanding HELP debts will be implemented from 1 June 2025, removing a total of $16 billion. Additionally, the HELP repayment threshold will be lifted.

* Investment in Healthcare: The budget includes significant funding for healthcare, such as $7.9 billion to expand bulk billing, additional Medicare Urgent Care Clinics, and increased support for public hospitals and GP training places.

For the full report click the link -

Federal Budget at a glance 2025-26 COPY

Click here for FREE Market Estimate of Value on your Home or (Simply send me a text to 0438 261 600 with your detials)