8 reasons why styling your home is important when selling

Grant Matterson LJ Hooker Narrabeen

In today’s post you will find-

Let’s take a look at the latest recent sales in the area

8 reasons why styling your home is important when selling

Prior market knowledge drives swift $1.01m Collaroy apartment sale

Understanding Land Tax in NSW: What You Need to Know

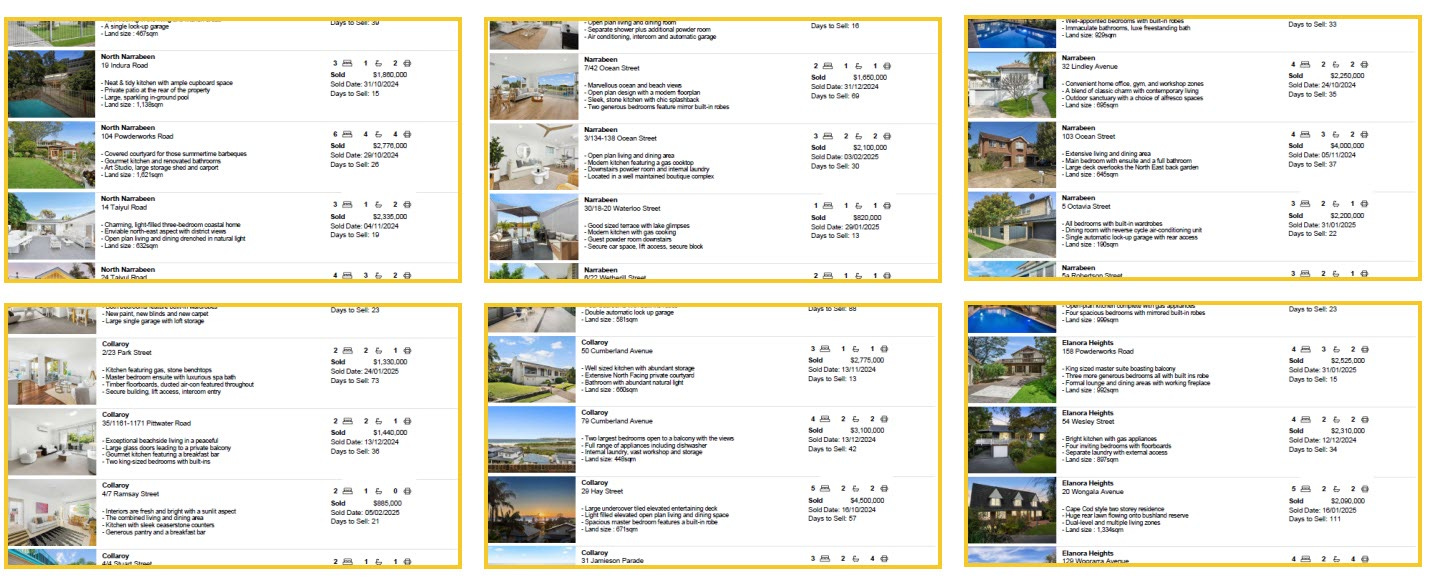

Let’s take a look at the latest recent sales in the area

Recent Local Sales

Click on the Links to View Local Recent Sales

Click here for FREE Market Estimate of Value on your Home or (Simply send me a text to 0438 261 600 with your detials)

8 reasons why styling your home is important when selling

Prior market knowledge drives swift $1.01m Collaroy apartment sale

A one-bedroom apartment at 6/11 The Avenue, Collaroy has sold for $1.01 million after just 15 days on market, with Grant Matterson and Geoff Amaral securing three competitive offers.

The accelerated result came from strategic timing and market intelligence. Grant was already working with a buyer from another transaction who needed a one-bedroom apartment in Collaroy, giving the team advance knowledge of demand before the property officially launched.

The one-bedroom, one-bathroom apartment with secure car space was sold via private treaty on 17 October 2025, with realistic pricing creating immediate competition.

Strategic advantage from dual representation

Grant explained how concurrent transactions provided market insight that benefited all parties.

“I was selling another owner’s property and he needed to buy a one-bedroom apartment in Collaroy, and we found this apartment as we had prior knowledge of it coming to the market,” he said.

“During that process, we worked for the vendor of the one-bedroom apartment. However, the buyer was really keen on it and competed against the other interested parties. It was listed at a realistic price, which created competition and escalated the sales price in a short period of time.”

The campaign attracted three formal offers, with location proving the decisive factor for the successful purchaser.

Location drives competitive outcome

The property’s proximity to Collaroy golf course and village amenities resonated strongly with buyers seeking lifestyle and convenience.

“The location in Collaroy and close to the golf course and all the amenities in the Collaroy Village” sealed the deal, Grant said.

The vendors expressed satisfaction with both the price achieved and the compressed timeframe.

“They were extremely happy with the sales price and the time frame,” Grant said.

According to Domain, one-bedroom apartments in Collaroy 2097 recorded a median price of $828,000 with 17 properties sold in the past 12 months and a rental yield of 2.4 per cent. The $1.01 million result positions this one-bedroom apartment above the suburb median, reflecting both property presentation and competitive market conditions.

Grant attributed the outcome to a buyer-focused approach that considers both selling and purchasing needs simultaneously.

“Working close with the buyers, whether they’re selling first or looking for a property to buy” created the strategic advantage, he said.

About the agent

Grant Matterson brings over 25 years of real estate experience to the Northern Beaches market as a licensed agent, accredited auctioneer and diploma-qualified professional at LJ Hooker Narrabeen. His approach focuses on presentation, promotion, pricing strategy and processes, earning Rate My Agent recognition for Narrabeen Agency of the Year in 2021, 2022 and 2023. Visit Grant’s website or call Grant on +61438261600.

https://eliteagent.com/grant-matterson-real-estate-collaroy-zkol9g/

Understanding Land Tax in NSW: What You Need to Know

You’ve probably heard of the term ‘land tax’ but may not be sure what it is all about or if it will impact you.

This NSW State Government tax is calculated annually on the unimproved value of your land without any buildings or structure. The good news is that it’s not payable on your own home and only kicks in once your investment landholdings exceed a certain threshold.

Knowing how the charge is applied is important particularly if you are an investor, developer or considering starting a property portfolio. There are penalties for not paying it, so it is key to gain an understanding. It is also a good idea to talk to your accountant and financial advisor about your plans and how it may impact your returns. Let’s breakdown everything about land tax including exemptions, recent reforms and some real-life scenarios.

Who pays land tax in NSW?

If you own a home and are not thinking of purchasing another property, then you can sigh relief as you won’t have to pay land tax on your primary residence. You may also be precluded if you meet other exemptions which we will look at later.

If you are an investor, then you will be taxed if your total landholdings once it exceeds the general threshold of $1,075,000 and a premium threshold of $6,751,000.

It is important to remember if you own multiple properties, their land values are added together to determine your liability.

How you structure your portfolio also matters – whether owned individually, jointly, through a trust or by a company – will change how the land tax is calculated and who is responsible for the payment. Some trusts are not eligible to receive the land tax threshold. Click here for more details.

Who is exempt from paying land tax in NSW?

Along with the family home, land tax is also not charged on primary production land such as farms. Other exemptions include land that is owned by charities, non-profit organisations, aged care facilities, boarding houses and childcare centres.

Eligible build-to-rent properties may also receive a 50 per cent reduction in land tax.

Revenue NSW receives information from other government agencies that will indicate whether you need to pay land tax such as acquiring property with a land value above the threshold, if you are renting out your previous home, or earning an income from your property during an extended absence,

Any land tax exemptions must be applied for through Revenue NSW, typically via the land tax online portal. For full details visit revenue.nsw.gov.au.

How is land tax calculated in NSW?

Unimproved land value refers to the value of property without any buildings or improvements. This value is determined by the NSW Valuer General as of 1 July each year. Revenue NSW uses a three-year average of land values to calculate how much is owning for land tax. The following example is provided by revenue.nsw.gov.au.

YearValue determined onYour land value20241 July 2023$1,050,00020251 July 2024$1,100,00020261 July 2025$1,150,000

Your average land value for tax purposes in the 2026 tax year is ($1,050,000 + $1,100,000 + $1,150,000) ÷ 3 = $1,100,000.

When comparing the above average land value against the current land tax threshold, we would calculate your liability as follows:

$1,100,000 (average land value) - $1,075,000 (general threshold) = $25,000 (taxable land value).

$25,000 x 1.6% + $100 (general land tax rate) = $500 total land tax liability.

Remember that the total amount needs to exceed the general threshold of $1,075,000.

Tax is assessed on all non-exempt land owned at midnight, 31 December with notices sent out from January each year.

When do you pay land tax in NSW?

Land tax notices are usually issued at the start of the year after valuation and averaging.

Once you receive your land tax assessment you will have 60 days to pay in full via BPAY, direct debit and credit card. If you don’t have access to funds, it may be possible to set up an interest-free payment plan.

Remember land tax is applied for the full year following December 31, each year. So even if you sell your property in February, you are required to pay for the full year. If you dispute your assessment, you also only have 60 days to lodge an objection.

You are legally required to keep all your land and contact details up to date with Revenue NSW. Importantly, if you did not receive an assessment and believe you are liable, then you need to update details on the Land Tax Online portal.

Understanding recent tax reforms in NSW

The State Government has a introduced a freeze on the annual indexation of land tax.

From 31 December 2025 and onwards, the general cut-off point will remain fixed at $1,075,000 and a premium rate of $6,571,000.

As a result, more investors will find their portfolio may be pushed above the tax line. Foreign investors will also feel the squeeze with a higher surcharge of land tax in additional to standard liabilities. The land tax surcharge is payable regardless of the value with no thresholds. From 2025 and onwards, this is five per cent of the land value of the property.

Also introduced is a tightening of principal place of residence rules requiring at least a 25 percent ownership share or a potential loss of exemption.

How land tax impacts different owners – scenario analysis

Let’s create some case studies illustrating how land tax impacts different owners.

Single property owner (individual) – if the unimproved land value of the property is below the threshold of $1,075,000 then no land tax is payable.

Single property owner (individual) – if the unimproved land value of the property is above the limit of $1,075,00 then the amount payable is $100 + 1.6 per cent of the land value above the threshold. For example, if the property has a land tax value of $1.8m, the estimated land tax payable would be $11,700.

High-value landowner crossing into premium threshold – the use of the word premium does not relate to property with harbour views or located in blue ribbon neighbourhood. It refers to if your total combined land-value exceeds the premium threshold rate of $6,571,000. It is calculated as $88,036 + 2 percent of the land value above $6,571,000. For example, if the combined land value of a portfolio totalled $8m, then expect your land tax bill to be $116,616.

Joint owners of multiple properties – A two-step assessment is used to make sure everyone pays land tax fairly. Joint owners are assessed as a single entity called the primary taxpayer. If a person owns multiple properties with other people, they will have multiple primary land tax accounts. A secondary assessment is issued where individuals are assessed for their portion of the joint owned land, along with any other property they own separately or other partnership. The same thresholds apply.

For example, if Mary and Tom own a property with a total land value of $1,200,000 – they pay $1,075,000 (general land tax threshold) x 1.6 per cent + $100) general land tax rate) = $2100. Mary will receive two assessment notices as she owns another property individually. To avoid being taxed twice, she will receive a secondary deduction.

For more information speak to Revenue NSW or speak with an independent financial advisor.

Foreign owner/surcharge – A foreign owner of residential land in NSW must pay 5 per cent surcharge land tax on the total land value in addition to regular tax. No tax-free threshold applies. For example, if a foreign person owns a property with a land valuation of $1,800,000 – they would pay an estimated land tax of $11,7000 + estimated land tax surcharge payable of $90,000 with a total payable of $101,700.

Practical tools and resources

If you are unsure how much to budget for land tax, the good news is there are heap of online resources to work out the amount. This includes a calculator on the Revenue NSW website. You’ll also find more details on latest rates and exemptions. These tools make it simple to plan and stay on top of your property tax rates.

Remember, each Australian state and territory has different land tax thresholds and rules. It’s important to stay up to date with regulations that apply to where your investment is located. If your portfolio is spread in more than one state, make sure you check your obligations for each one.

LJ Hooker is here to help

When you are ready to start or add to your property portfolio in NSW, be sure to contact your nearest LJ Hooker agent. They are specialists who are experienced in helping people looking to get started in investing and can access property databases and valuation tools.

Importantly, they understand the NSW investment market and can also arrange for an experienced property manager to take care of the property. This reduces the burden on you as a landlord and will allow you to focus on growing your portfolio.

Don’t forget to be a tax-smart investor by getting all your documentation in order from the start. This includes knowing what expenses can be claimed, your tax obligations and declaring all rental-related income in your annual return.

https://www.ljhooker.com.au/blog/land-tax-in-nsw

The Complete Guide To Selling Your Home.

Click here for FREE Market Estimate of Value on your Home or (Simply send me a text to 0438 261 600 with your detials)